Property Information

mobile view

| Serial Number: 25:069:0091 |

Serial Life: 2009... |

|

|

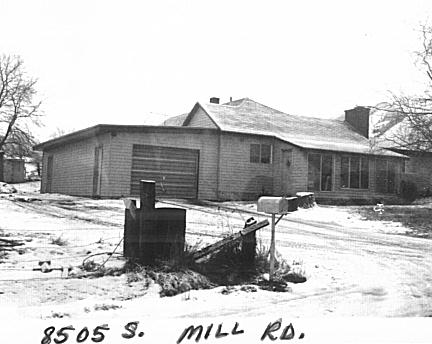

Total Photos: 1

|

| |

|

|

| Property Address: 8505 S MILL RD - SALEM |

|

| Mailing Address: 223 N MAIN ST SALEM, UT 84653-9446 |

|

| Acreage: 6.318 |

|

| Last Document:

133229-2008

|

|

| Subdivision Map Filing |

|

| Taxing Description:

COM N 2057.45 FT & W 29.97 FT FR S 1/4 COR. SEC. 36, T8S, R2E, SLB&M.; N 22 DEG 45' 0" E 128.84 FT; N 10 DEG 15' 0" W 410.52 FT; W 69.96 FT; N 24 DEG 32' 31" E 102.71 FT; E 49.47 FT; S 33 FT; E 245.52 FT; S 22 DEG 45' 0" W 118.8 FT; E 467.28 FT; S 22 DEG 45' 0" W 110.92 FT; S 89 DEG 57' 12" W 33.93 FT; S 20 DEG 44' 40" W 107.39 FT; N 89 DEG 48' 19" E 29.98 FT; S 22 DEG 45' 0" W 247.54 FT; W 271.81 FT; S 30.39 FT; S 86 DEG 41' 22" W 213.75 FT TO BEG. AREA 6.318 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$212,700 |

$390,900 |

$603,600 |

$0 |

$268,100 |

$0 |

$268,100 |

$79 |

$112,000 |

$112,079 |

$871,700 |

| 2023 |

$0 |

$212,700 |

$390,900 |

$603,600 |

$0 |

$277,600 |

$0 |

$277,600 |

$73 |

$112,000 |

$112,073 |

$881,200 |

| 2022 |

$0 |

$226,800 |

$416,800 |

$643,600 |

$0 |

$268,000 |

$0 |

$268,000 |

$73 |

$112,000 |

$112,073 |

$911,600 |

| 2021 |

$0 |

$162,000 |

$208,400 |

$370,400 |

$0 |

$201,500 |

$0 |

$201,500 |

$73 |

$80,000 |

$80,073 |

$571,900 |

| 2020 |

$0 |

$135,000 |

$186,100 |

$321,100 |

$0 |

$201,500 |

$0 |

$201,500 |

$248 |

$28,000 |

$28,248 |

$522,600 |

| 2019 |

$0 |

$110,000 |

$159,500 |

$269,500 |

$0 |

$183,200 |

$0 |

$183,200 |

$249 |

$28,000 |

$28,249 |

$452,700 |

| 2018 |

$0 |

$100,000 |

$159,500 |

$259,500 |

$0 |

$159,300 |

$0 |

$159,300 |

$276 |

$28,000 |

$28,276 |

$418,800 |

| 2017 |

$0 |

$100,000 |

$159,500 |

$259,500 |

$0 |

$159,300 |

$0 |

$159,300 |

$289 |

$28,000 |

$28,289 |

$418,800 |

| 2016 |

$0 |

$58,000 |

$106,400 |

$164,400 |

$0 |

$177,000 |

$0 |

$177,000 |

$283 |

$28,000 |

$28,283 |

$341,400 |

| 2015 |

$0 |

$55,000 |

$106,400 |

$161,400 |

$0 |

$167,000 |

$0 |

$167,000 |

$281 |

$28,000 |

$28,281 |

$328,400 |

| 2014 |

$0 |

$55,000 |

$106,400 |

$161,400 |

$0 |

$167,000 |

$0 |

$167,000 |

$291 |

$28,000 |

$28,291 |

$328,400 |

| 2013 |

$0 |

$50,000 |

$101,200 |

$151,200 |

$0 |

$142,700 |

$0 |

$142,700 |

$295 |

$28,000 |

$28,295 |

$293,900 |

| 2012 |

$0 |

$80,000 |

$175,600 |

$255,600 |

$0 |

$158,600 |

$0 |

$158,600 |

$293 |

$28,000 |

$28,293 |

$414,200 |

| 2011 |

$0 |

$80,000 |

$175,600 |

$255,600 |

$0 |

$158,600 |

$0 |

$158,600 |

$288 |

$28,000 |

$28,288 |

$414,200 |

| 2010 |

$0 |

$80,000 |

$175,600 |

$255,600 |

$0 |

$158,600 |

$0 |

$158,600 |

$288 |

$28,000 |

$28,288 |

$414,200 |

| 2009 |

$0 |

$80,000 |

$175,600 |

$255,600 |

$0 |

$158,600 |

$0 |

$158,600 |

$288 |

$28,000 |

$28,288 |

$414,200 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2024 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2023 |

$2,142.67 |

$0.00 |

$2,142.67 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2022 |

$2,128.15 |

$0.00 |

$2,128.15 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2021 |

$1,835.85 |

$0.00 |

$1,835.85 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2020 |

$1,543.86 |

$0.00 |

$1,543.86 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2019 |

$1,392.60 |

$0.00 |

$1,392.60 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2018 |

$1,291.55 |

$0.00 |

$1,291.55 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2017 |

$1,328.70 |

$0.00 |

$1,328.70 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2016 |

$1,499.50 |

$0.00 |

$1,499.50 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2015 |

$1,438.55 |

$0.00 |

$1,438.55 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2014 |

$1,437.93 |

$0.00 |

$1,437.93 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2013 |

$1,309.95 |

$0.00 |

$1,309.95 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2012 |

$1,449.67 |

$0.00 |

$1,449.67 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2011 |

$1,423.25 |

$0.00 |

$1,423.25 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2010 |

$1,390.32 |

$0.00 |

$1,390.32 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2009 |

$1,330.11 |

$0.00 |

$1,330.11 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 29207-2022 |

03/07/2022 |

03/08/2022 |

REC |

ZIONS FIRST NATIONAL BANK TEE |

LYMAN, KEITH LYNN & GLENDA B |

| 21370-2019 |

02/26/2019 |

03/15/2019 |

ORDIN |

UTAH COUNTY |

WHOM OF INTEREST |

| 2730-2019 |

09/11/2018 |

01/11/2019 |

ORDIN |

UTAH COUNTY |

WHOM OF INTEREST |

| 3187-2015 |

12/04/2014 |

01/14/2015 |

QCD |

UNITED STATES OF AMERICA |

SOUTH UTAH VALLEY ELECTRIC SERVICE DISTRICT |

| 43710-2014 |

06/10/2014 |

06/26/2014 |

D TR |

LYMAN, KEITH LYNN & GLENDA B |

ZIONS FIRST NATIONAL BANK |

| 50963-2009 |

05/04/2009 |

05/08/2009 |

CT |

STATE OF UTAH |

WHOM OF INTEREST |

| 42373-2009 |

04/21/2009 |

04/21/2009 |

RESOL |

BOARD OF COUNTY COMMISSIONERS UTAH COUNTY |

WHOM OF INTEREST |

| 133229-2008 |

11/26/2008 |

12/23/2008 |

FLA |

ZOBELL, KEITH W |

LYMAN, GLENDA B & KEITH L (ET AL) |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 5/20/2024 7:51:28 AM |