Property Information

mobile view

| Serial Number: 24:049:0011 |

Serial Life: 1977... |

|

|

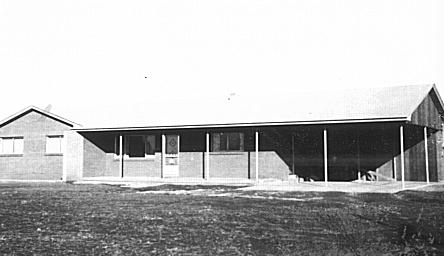

Total Photos: 1

|

| |

|

|

| Property Address: 510 W 1000 NORTH - SPANISH FORK |

|

| Mailing Address: 510 W 1000 N SPANISH FORK, UT 84660-9510 |

|

| Acreage: 2.29545 |

|

| Last Document:

29425-2019

|

|

| Subdivision Map Filing |

|

| Taxing Description:

COM N 282.7 FT & E 3057.7 FT FR W 1/4 COR. SEC. 13 T8S R2E SLB&M.; N 5 DEG 33' 0" W 665.5 FT; N 89 DEG 48' 0" W 151 FT; S 5 DEG 33' 0" E 665.6 FT; S 89 DEG 51' 0" E 151 FT TO BEG. AREA 2.295 AC.

*Taxing description NOT FOR LEGAL DOCUMENTS

|

|

- Owner Names

- Value History

- Tax History

- Location

- Photos

- Documents

- Aerial Image

| |

----- Real Estate Values ----- |

---Improvements--- |

---Greenbelt--- |

Total |

| Year |

Com |

Res |

Agr |

Tot |

Com |

Res |

Agr |

Tot |

Land |

Homesite |

Tot |

Market Value |

| 2024 |

$0 |

$219,300 |

$139,800 |

$359,100 |

$0 |

$244,500 |

$0 |

$244,500 |

$0 |

$0 |

$0 |

$603,600 |

| 2023 |

$0 |

$219,300 |

$139,700 |

$359,000 |

$0 |

$259,900 |

$0 |

$259,900 |

$0 |

$0 |

$0 |

$618,900 |

| 2022 |

$0 |

$233,800 |

$149,000 |

$382,800 |

$0 |

$227,300 |

$0 |

$227,300 |

$0 |

$0 |

$0 |

$610,100 |

| 2021 |

$0 |

$137,500 |

$74,500 |

$212,000 |

$0 |

$215,200 |

$0 |

$215,200 |

$0 |

$0 |

$0 |

$427,200 |

| 2020 |

$0 |

$125,000 |

$64,800 |

$189,800 |

$0 |

$193,900 |

$0 |

$193,900 |

$0 |

$0 |

$0 |

$383,700 |

| 2019 |

$0 |

$115,000 |

$45,300 |

$160,300 |

$0 |

$193,900 |

$0 |

$193,900 |

$0 |

$0 |

$0 |

$354,200 |

| 2018 |

$0 |

$105,000 |

$45,300 |

$150,300 |

$0 |

$168,600 |

$0 |

$168,600 |

$0 |

$0 |

$0 |

$318,900 |

| 2017 |

$0 |

$94,000 |

$45,300 |

$139,300 |

$0 |

$168,600 |

$0 |

$168,600 |

$0 |

$0 |

$0 |

$307,900 |

| 2016 |

$0 |

$68,000 |

$31,100 |

$99,100 |

$0 |

$168,600 |

$0 |

$168,600 |

$0 |

$0 |

$0 |

$267,700 |

| 2015 |

$0 |

$65,000 |

$31,100 |

$96,100 |

$0 |

$168,600 |

$0 |

$168,600 |

$0 |

$0 |

$0 |

$264,700 |

| 2014 |

$0 |

$65,000 |

$31,100 |

$96,100 |

$0 |

$168,600 |

$0 |

$168,600 |

$0 |

$0 |

$0 |

$264,700 |

| 2013 |

$0 |

$67,000 |

$31,100 |

$98,100 |

$0 |

$144,100 |

$0 |

$144,100 |

$0 |

$0 |

$0 |

$242,200 |

| 2012 |

$0 |

$70,000 |

$31,100 |

$101,100 |

$0 |

$131,000 |

$0 |

$131,000 |

$0 |

$0 |

$0 |

$232,100 |

| 2011 |

$0 |

$70,000 |

$31,100 |

$101,100 |

$0 |

$145,800 |

$0 |

$145,800 |

$0 |

$0 |

$0 |

$246,900 |

| 2010 |

$0 |

$70,000 |

$10,112 |

$80,112 |

$0 |

$187,688 |

$0 |

$187,688 |

$0 |

$0 |

$0 |

$267,800 |

| 2009 |

$0 |

$77,000 |

$31,800 |

$108,800 |

$0 |

$159,000 |

$0 |

$159,000 |

$0 |

$0 |

$0 |

$267,800 |

| 2008 |

$0 |

$77,000 |

$31,800 |

$108,800 |

$0 |

$159,000 |

$0 |

$159,000 |

$0 |

$0 |

$0 |

$267,800 |

| 2007 |

$0 |

$77,000 |

$31,800 |

$108,800 |

$0 |

$159,000 |

$0 |

$159,000 |

$0 |

$0 |

$0 |

$267,800 |

| 2006 |

$0 |

$77,000 |

$31,800 |

$108,800 |

$0 |

$159,000 |

$0 |

$159,000 |

$0 |

$0 |

$0 |

$267,800 |

| 2005 |

$0 |

$31,888 |

$40,500 |

$72,388 |

$0 |

$128,965 |

$0 |

$128,965 |

$0 |

$0 |

$0 |

$201,353 |

| 2004 |

$0 |

$31,888 |

$40,500 |

$72,388 |

$0 |

$128,965 |

$0 |

$128,965 |

$0 |

$0 |

$0 |

$201,353 |

| 2003 |

$0 |

$31,888 |

$40,500 |

$72,388 |

$0 |

$128,965 |

$0 |

$128,965 |

$0 |

$0 |

$0 |

$201,353 |

| 2002 |

$0 |

$31,888 |

$40,500 |

$72,388 |

$0 |

$128,965 |

$0 |

$128,965 |

$0 |

$0 |

$0 |

$201,353 |

| 2001 |

$0 |

$27,729 |

$35,217 |

$62,946 |

$0 |

$103,172 |

$0 |

$103,172 |

$0 |

$0 |

$0 |

$166,118 |

| 2000 |

$0 |

$25,915 |

$32,913 |

$58,828 |

$0 |

$92,440 |

$0 |

$92,440 |

$0 |

$0 |

$0 |

$151,268 |

| 1999 |

$0 |

$29,803 |

$29,025 |

$58,828 |

$0 |

$92,440 |

$0 |

$92,440 |

$0 |

$0 |

$0 |

$151,268 |

| 1998 |

$0 |

$29,803 |

$29,025 |

$58,828 |

$0 |

$92,440 |

$0 |

$92,440 |

$0 |

$0 |

$0 |

$151,268 |

| 1997 |

$0 |

$27,882 |

$30,946 |

$58,828 |

$0 |

$92,440 |

$0 |

$92,440 |

$0 |

$0 |

$0 |

$151,268 |

| 1996 |

$0 |

$23,878 |

$30,946 |

$54,824 |

$0 |

$79,164 |

$0 |

$79,164 |

$0 |

$0 |

$0 |

$133,988 |

| 1995 |

$0 |

$21,707 |

$28,133 |

$49,840 |

$0 |

$79,164 |

$0 |

$79,164 |

$0 |

$0 |

$0 |

$129,004 |

| 1994 |

$0 |

$12,694 |

$16,452 |

$29,146 |

$0 |

$63,842 |

$0 |

$63,842 |

$0 |

$0 |

$0 |

$92,988 |

| 1993 |

$0 |

$12,694 |

$16,452 |

$29,146 |

$0 |

$63,842 |

$0 |

$63,842 |

$0 |

$0 |

$0 |

$92,988 |

| 1992 |

$0 |

$11,646 |

$15,094 |

$26,740 |

$0 |

$58,571 |

$0 |

$58,571 |

$0 |

$0 |

$0 |

$85,311 |

| 1991 |

$0 |

$10,216 |

$13,240 |

$23,456 |

$0 |

$51,378 |

$0 |

$51,378 |

$0 |

$0 |

$0 |

$74,834 |

| 1990 |

$0 |

$10,216 |

$13,240 |

$23,456 |

$0 |

$51,378 |

$0 |

$51,378 |

$0 |

$0 |

$0 |

$74,834 |

| 1989 |

$0 |

$10,216 |

$13,240 |

$23,456 |

$0 |

$51,378 |

$0 |

$51,378 |

$0 |

$0 |

$0 |

$74,834 |

| 1988 |

$0 |

$10,217 |

$13,240 |

$23,457 |

$0 |

$51,378 |

$0 |

$51,378 |

$0 |

$0 |

$0 |

$74,835 |

| 1987 |

$0 |

$10,533 |

$13,650 |

$24,183 |

$0 |

$52,967 |

$0 |

$52,967 |

$0 |

$0 |

$0 |

$77,150 |

| 1986 |

$0 |

$10,534 |

$13,650 |

$24,184 |

$0 |

$52,968 |

$0 |

$52,968 |

$0 |

$0 |

$0 |

$77,152 |

| 1985 |

$0 |

$10,533 |

$13,650 |

$24,183 |

$0 |

$52,966 |

$0 |

$52,966 |

$0 |

$0 |

$0 |

$77,149 |

| 1984 |

$0 |

$10,642 |

$13,788 |

$24,430 |

$0 |

$53,500 |

$0 |

$53,500 |

$0 |

$0 |

$0 |

$77,930 |

| Year |

General Taxes |

Adjustments |

Net Taxes |

Fees |

Payments |

Tax Balance* |

Balance Due |

Tax District |

| 2025 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2024 |

$0.00 |

$0.00 |

$0.00 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2023 |

$3,907.99 |

$0.00 |

$3,907.99 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2022 |

$3,978.14 |

$0.00 |

$3,978.14 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2021 |

$3,015.09 |

$0.00 |

$3,015.09 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2020 |

$2,774.49 |

$0.00 |

$2,774.49 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2019 |

$2,362.63 |

$0.00 |

$2,362.63 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2018 |

$2,223.67 |

$0.00 |

$2,223.67 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2017 |

$2,205.04 |

$0.00 |

$2,205.04 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2016 |

$1,898.97 |

$0.00 |

$1,898.97 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2015 |

$1,902.19 |

$0.00 |

$1,902.19 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2014 |

$1,895.33 |

$0.00 |

$1,895.33 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2013 |

$1,833.00 |

$0.00 |

$1,833.00 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2012 |

$1,786.91 |

$0.00 |

$1,786.91 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2011 |

$1,847.51 |

$0.00 |

$1,847.51 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2010 |

$1,825.42 |

$0.00 |

$1,825.42 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2009 |

$1,839.01 |

$0.00 |

$1,839.01 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2008 |

$1,708.76 |

$0.00 |

$1,708.76 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2007 |

$1,712.31 |

$0.00 |

$1,712.31 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2006 |

$1,855.01 |

$0.00 |

$1,855.01 |

$0.00 |

|

$0.00

|

$0.00 |

150 - SPANISH FORK CITY |

| 2005 |

$1,714.00 |

$0.00 |

$1,714.00 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2004 |

$1,713.74 |

$0.00 |

$1,713.74 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2003 |

$1,574.20 |

$0.00 |

$1,574.20 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2002 |

$1,535.12 |

$0.00 |

$1,535.12 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2001 |

$1,296.42 |

$0.00 |

$1,296.42 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 2000 |

$1,168.75 |

$0.00 |

$1,168.75 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 1999 |

$1,091.67 |

$0.00 |

$1,091.67 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 1998 |

$1,076.66 |

$0.00 |

$1,076.66 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 1997 |

$1,184.22 |

$0.00 |

$1,184.22 |

$0.00 |

|

$0.00

|

$0.00 |

120 - NEBO SCHOOL DIST S/A 6-7-8 |

| 1996 |

$930.95 |

$0.00 |

$930.95 |

$0.00 |

|

$0.00

|

$0.00 |

125 - NEBO SCHOOL DIST S/A 6-9 |

| 1995 |

$887.46 |

$0.00 |

$887.46 |

$0.00 |

|

$0.00

|

$0.00 |

125 - NEBO SCHOOL DIST S/A 6-9 |

| 1994 |

$906.56 |

$0.00 |

$906.56 |

$0.00 |

|

$0.00

|

$0.00 |

125 - NEBO SCHOOL DIST S/A 6-9 |

| 1993 |

$810.23 |

$0.00 |

$810.23 |

$0.00 |

|

$0.00

|

$0.00 |

125 - NEBO SCHOOL DIST S/A 6-9 |

| 1992 |

$719.04 |

$0.00 |

$719.04 |

$0.00 |

|

$0.00

|

$0.00 |

125 - NEBO SCHOOL DIST S/A 6-9 |

| 1991 |

$658.27 |

$0.00 |

$658.27 |

$0.00 |

|

$0.00

|

$0.00 |

125 - NEBO SCHOOL DIST S/A 6-9 |

| 1990 |

$628.74 |

$0.00 |

$628.74 |

$0.00 |

|

$0.00

|

$0.00 |

125 - NEBO SCHOOL DIST S/A 6-9 |

| 1989 |

$646.29 |

$0.00 |

$646.29 |

$0.00 |

|

$0.00

|

$0.00 |

125 - NEBO SCHOOL DIST S/A 6-9 |

| 1988 |

$641.06 |

$0.00 |

$641.06 |

$0.00 |

|

$0.00

|

$0.00 |

125 - NEBO SCHOOL DIST S/A 6-9 |

| 1987 |

$646.18 |

$0.00 |

$646.18 |

$0.00 |

|

$0.00

|

$0.00 |

125 - NEBO SCHOOL DIST S/A 6-9 |

| 1986 |

$613.49 |

$0.00 |

$613.49 |

$0.00 |

|

$0.00

|

$0.00 |

125 - NEBO SCHOOL DIST S/A 6-9 |

| 1985 |

$568.63 |

$0.00 |

$568.63 |

$0.00 |

|

$0.00

|

$0.00 |

125 - NEBO SCHOOL DIST S/A 6-9 |

| 1984 |

$558.23 |

$0.00 |

$558.23 |

$0.00 |

|

$0.00

|

$0.00 |

125 - NEBO SCHOOL DIST S/A 6-9 |

* Note: Original tax amount (Does not include applicable interest and/or fees).

| Entry # |

Date |

Recorded |

Type |

Party1 (Grantor) |

Party2 (Grantee) |

| 17186-2024 |

11/01/2023 |

03/19/2024 |

WATER D |

SHEPHERD, VALERIE TEE (ET AL) |

STRAWBERRY WATER USERS ASSOCIATION |

| 29425-2019 |

01/23/2019 |

04/10/2019 |

WD |

MORRILL, ERLYNN |

MORRILL, ERLYNN TEE (ET AL) |

| 11024-2017 |

01/31/2017 |

02/02/2017 |

REC |

PRO-TITLE AND ESCROW INC TEE |

MORRILL, ERLYNN |

| 9857-2017 |

01/25/2017 |

01/31/2017 |

D TR |

MORRILL, ERLYNN |

NEBO CREDIT UNION |

| 3187-2015 |

12/04/2014 |

01/14/2015 |

QCD |

UNITED STATES OF AMERICA |

SOUTH UTAH VALLEY ELECTRIC SERVICE DISTRICT |

| 114949-2008 |

10/20/2008 |

10/22/2008 |

CT |

STATE OF UTAH |

WHOM OF INTEREST |

| 107508-2008 |

09/30/2008 |

09/30/2008 |

RESOL |

BOARD OF COUNTY COMMISSIONERS UTAH COUNTY |

WHOM OF INTEREST |

| 4152-2006 |

12/09/2005 |

01/12/2006 |

CER |

STATE OF UTAH |

WHOM OF INTEREST |

| 89232-2005 |

07/05/2005 |

08/15/2005 |

ORDIN |

SPANISH FORK CITY |

WHOM OF INTEREST |

| 89231-2005 |

07/05/2005 |

08/15/2005 |

A PLAT |

HILL ANNEXATION |

SPANISH FORK CITY CORPORATION |

| 125734-2004 |

10/19/2004 |

11/05/2004 |

D TR |

MORRILL, ERELYNN |

NEBO CREDIT UNION |

| 125733-2004 |

10/19/2004 |

11/05/2004 |

AF DC |

MERRILL, TERRY HINTON & TERRY H AKA |

WHOM OF INTEREST |

| 126698-2003 |

|

08/08/2003 |

REL |

WASHINGTON MUTUAL BANK |

MORRIL, TERRY H & ERLYNN |

| 33924-1999 |

03/18/1999 |

03/23/1999 |

D TR |

MORRILL, TERRY H & ERLYNN |

FLEET MORTGAGE CORP |

| 16150-1990 |

|

05/23/1990 |

S ORDIN |

UTAH COUNTY COMMISSIONERS |

WHOM OF INTEREST |

| 16149-1990 |

05/14/1990 |

05/23/1990 |

S ORDIN |

UTAH COUNTY COMMISSIONERS |

WHOM OF INTEREST |

| 16144-1990 |

|

05/23/1990 |

Z MAP |

UTAH COUNTY COMMISSIONERS |

WHOM OF INTEREST |

| 16143-1990 |

|

05/23/1990 |

Z ORDIN |

UTAH COUNTY COMMISSIONERS |

WHOM OF INTEREST |

| 16142-1990 |

05/14/1990 |

05/23/1990 |

Z ORDIN |

UTAH COUNTY COMMISSIONERS |

WHOM OF INTEREST |

| 45049-1987 |

12/10/1987 |

12/14/1987 |

REC |

CENTRAL BANK & TRUST COMPANY TEE |

MORRILL, TERRY H & ERLYNN |

| 15320-1987 |

04/20/1987 |

04/22/1987 |

REC |

WESTERN STATES TITLE INSURANCE COMPANY TEE |

JOHNSON, W TAYLOR & LONETA N |

| 38610-1980 |

10/27/1980 |

11/06/1980 |

REC |

CENTRAL BANK & TRUST COMPANY TEE |

MORRILL, TERRY H & ERLYNN |

Main Menu Comments or Concerns on Value/Appraisal - Assessor's Office

Documents/Owner/Parcel information - Recorder's Office

Address Change for Tax Notice

This page was created on 5/20/2024 9:20:43 AM |